Financial goals and missteps often vary based on a service member’s age and rank. Younger troops are typically more focused on budgeting and day-to-day spending habits to improve cash flow and avoid overspending. More seasoned troops tend to focus on debt elimination and long-term savings to improve credit ratings and avoid inadequate income during retirement. All of these goals are appropriate and attainable.

For service members participating in the government Thrift Savings Plan (TSP) retirement program, there is one mistake being made by ALL ranks. Not contributing your tax-free combat pay to the Roth TSP during your deployment.

Many of you are currently contributing a portion of your base pay to the Traditional TSP. Under this type of account, money is taken from your pay before taxes are withheld, lowering your taxable income today. When Traditional TSP funds are withdrawn during retirement, they are taxed based on your tax rate at that time. You not only pay taxes on the money you’ve contributed, you also pay taxes on the interest or growth that has accumulated over time. When you contribute tax-free combat pay to this account, you won’t ever pay taxes on that income. However, its growth will be taxed. For most investors, the majority of your account balance will consist of interest earnings, not contributions. Use this calculator from www.tsp.gov to determine the amount of interest you’re likely to have in your account.

The Roth TSP allows you to choose the same contribution amount as the Traditional TSP, and your money will continue to go in the funds you’ve already chosen (G, C, S, I, L). However, taxes are paid today based on your current tax rate. When Roth TSP funds are withdrawn during retirement, you will not pay any additional taxes. Bottom line, the interest or growth that accumulates over time is TAX-FREE. When in a combat zone, you may elect to contribute your tax-free combat pay to your Roth TSP and never, ever pay taxes on that income and its growth. This is a significant benefit you should be taking advantage of during deployment.

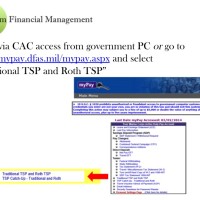

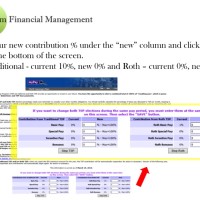

Follow these simple steps to maximize your retirement earnings. It only takes 3 minutes to make this change and save thousands in taxes.

When you make this change, you will have two separate TSP accounts and your statements will reflect that change.