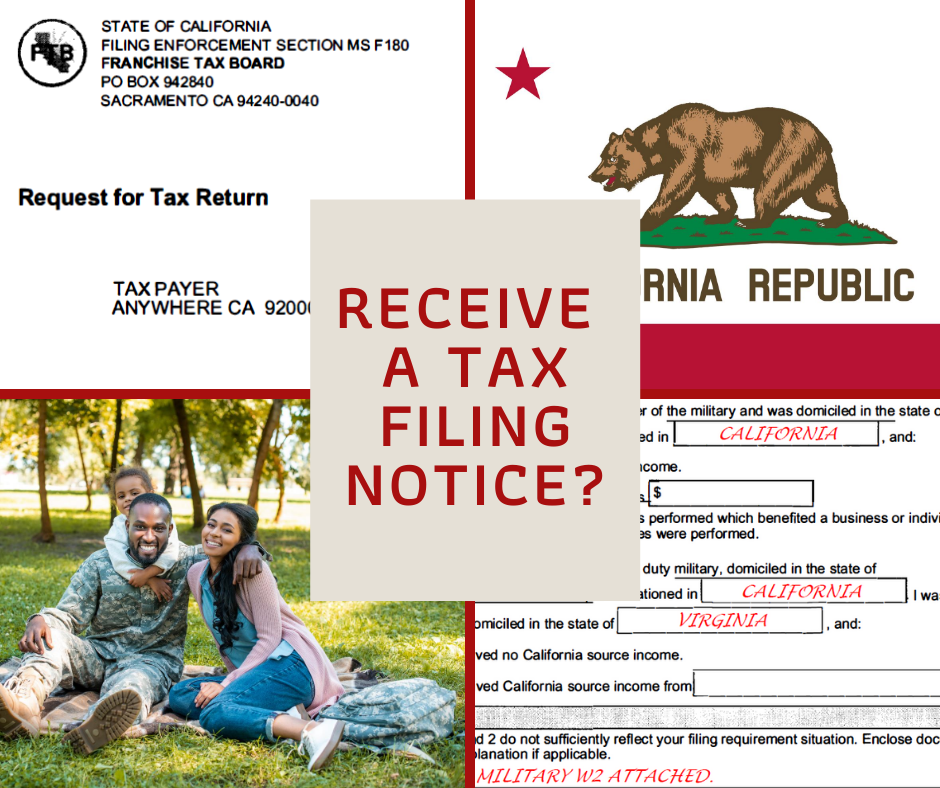

Taxpayers who filed a federal tax return with a California (CA) address listed on their 1040, will likely receive a computer generated letter requesting a CA state tax return be filed. When you receive this letter, do not panic! Most military families stationed in CA will get it at some point during their assignment.

If you fall under these two categories, please use the PDF below to aid you in responding to the state.

- I prepared your taxes for the year in question and I did not file a CA tax return for you (this means I’ve already determined you do not have a filing requirement).

- I did not prepare your taxes for the year in question, however, neither the active duty service member nor the nonmilitary spouse is a CA resident and state income taxes were paid to another state.

*You only need to complete the portions on Page 3 and mail it back to the address shown on Page 4. You’ll notice I used Virginia in this sample, so remember to write the state shown on the service members W-2.