by Attiyya | Feb 3, 2017 | Taxes

If your teenager received a W-2, reporting income they earned in 2016, check to see if federal taxes were withheld. Nine times out of ten, they’ll get the full amount refunded to them when they file a tax return. If you’re already an Ingram Financial...

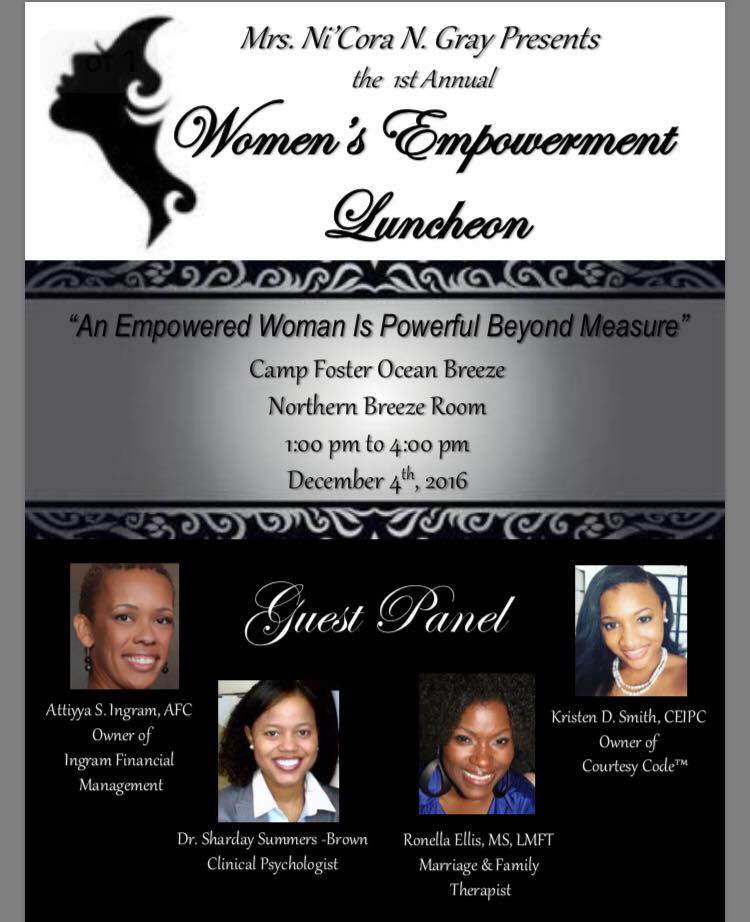

by Attiyya | Nov 7, 2016 | Financial Counseling, Taxes

Join me for this FREE event.

by Attiyya | Mar 21, 2016 | Taxes

The summer 2015 OPM breach continues to affect service members this tax season. There have been many reports of tax returns being fraudulently filed, delaying refunds for several months. If your social security number has been compromised and your electronically...

by Attiyya | Jan 23, 2016 | Taxes

Any Commanding Officer (CO) of a military unit will tell you that leading an organization is an honor and a privilege. One of the hidden realities is it can also be very expensive – some estimate they’ve spent close to $10,000 during a command tour! The...

by Attiyya | Jan 20, 2016 | Taxes

The tax gap is the amount of tax unpaid each year from underreporting taxable income, mostly from honest taxpayers who don’t fully understand the requirements. Most people are aware that income earned from an employer (W-2), bank interest/dividends...

by Attiyya | Jan 17, 2016 | Taxes

The IRS will begin accepting and processing tax returns on Tuesday, January 19th. If you plan to file electronically, like millions of other taxpayers, you’ll need to verify your identity by providing either your Self-Select PIN or 2014 Adjusted Gross Income...