by Attiyya | Dec 7, 2018 | Taxes

Every Friday in December leading up to Christmas, I’ll be giving away several FREE copies of one of my favorite books. Naturally, I’m kicking this years give-a-way off with my own eBook! Visit my Facebook page to get your copy! Merry Christmas!...

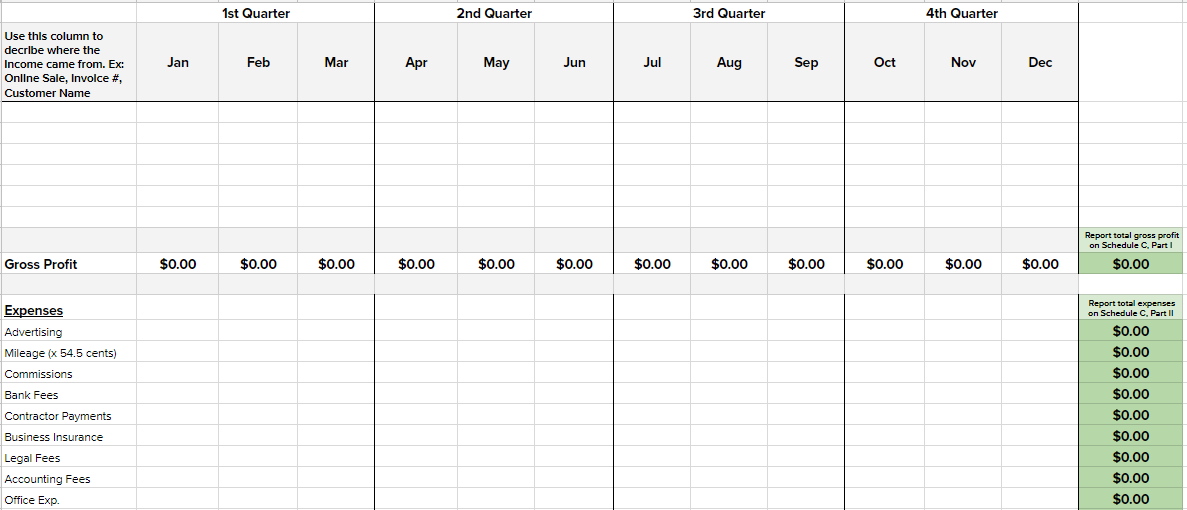

by Attiyya | Dec 1, 2018 | Taxes

This spreadsheet is perfect for small business owners looking for a simple way to organize their business finances and stay in compliance with federal and state estimated tax payments. This sheet will tell if you should submit estimated taxes and will make filing your...

by Attiyya | Oct 19, 2018 | Taxes

The premier and comprehensive guide to understanding the MSRRA and avoiding excessive taxation is now available as an eBook! Written specifically for military spouses and those who prepare income taxes for military families. State specific filing requirements and form...

by Attiyya | Sep 10, 2018 | Financial Counseling, Taxes

As you’re well aware by now, tax laws have changed for 2018. With just over 3 months left in the year, now is a good time to see how these changes will affect your bottom line. Contact me to obtain your 2018 individual tax planner. 1 – Standard Deduction...

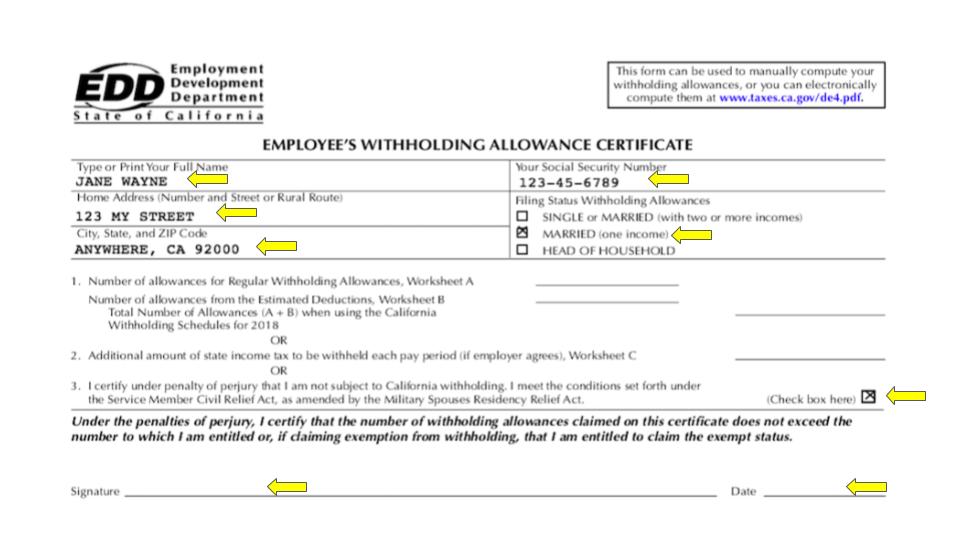

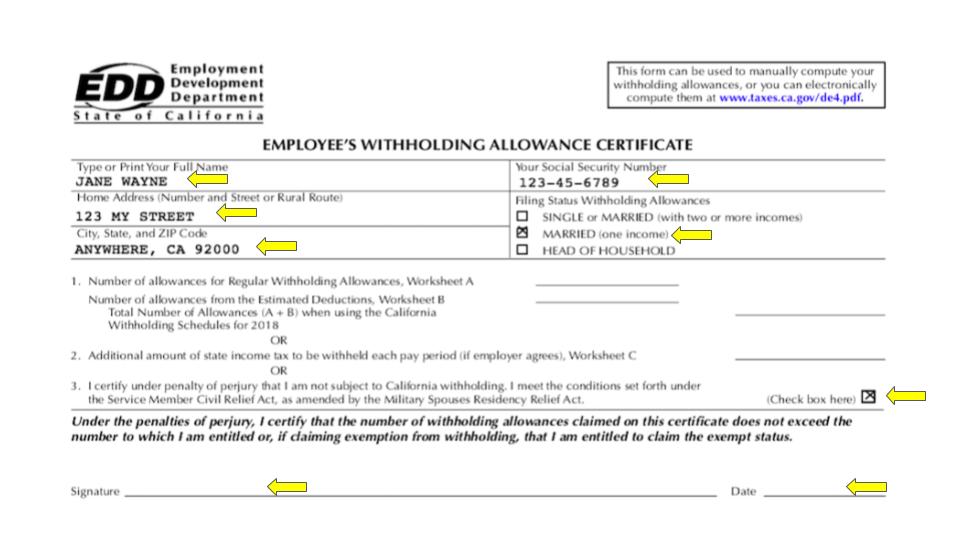

by Attiyya | Sep 6, 2018 | Financial Counseling, Taxes

Federal Withholdings In years prior, your federal W-4 was based on the number of personal exemptions you claimed on your tax return. With personal exemption now gone, the 2020 W-4 is designed to help you determine the dollar amount your employer should withhold from...

by Attiyya | Aug 2, 2018 | Taxes

What is the best way to contact you for help with my taxes? Completing the contact form on this site is the best way to reach me. You can also email me directly at [email protected]. I typically reply to emails within 48 hours. Do you prepare business returns? I...