by Attiyya | Dec 22, 2015 | Taxes

The IRS will begin accepting individual electronic tax returns on Tuesday, January 19, 2016. In addition, the filing deadline for submitting 2015 returns has been extended a few days to, Monday, April 18, 2016. Contact me today for tax filing assistance....

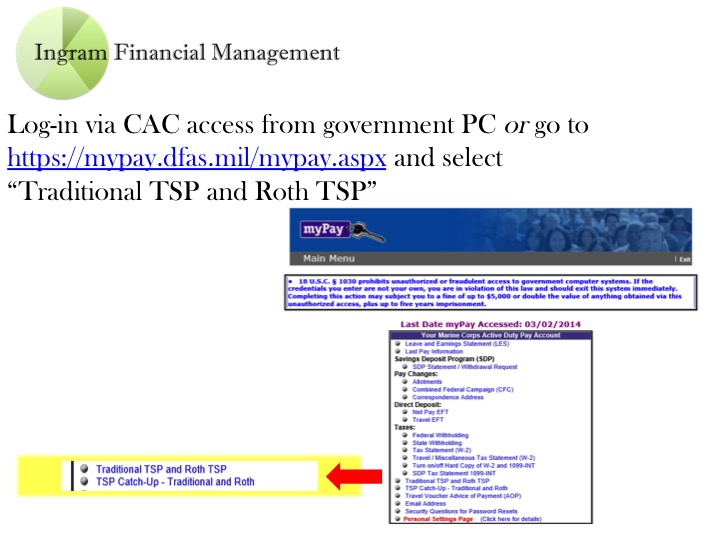

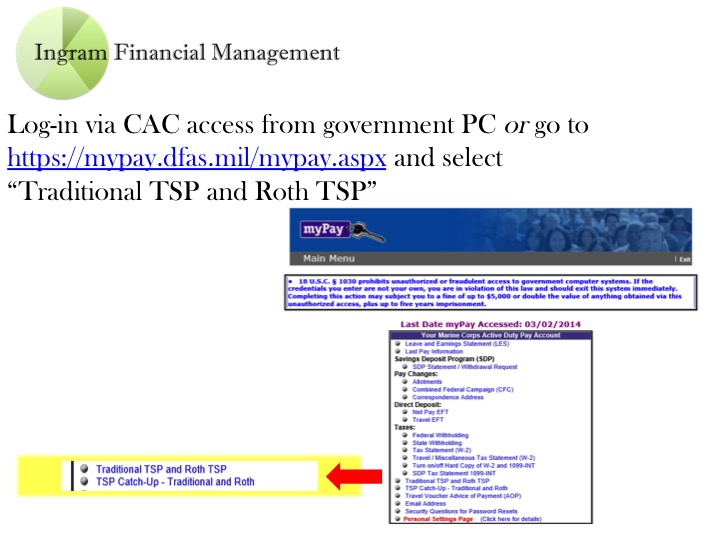

by Attiyya | Aug 26, 2015 | Financial Counseling, Taxes

Making it in the MilLife® – Keeping a Career on the Move®

by Attiyya | Apr 27, 2015 | Financial Counseling, Taxes

Financial goals and missteps often vary based on a service member’s age and rank. Younger troops are typically more focused on budgeting and day-to-day spending habits to improve cash flow and avoid overspending. More seasoned troops tend to focus on debt...

by Attiyya | Mar 22, 2015 | Taxes

The Earned Income Tax Credit (EITC or EIC) is a monetary benefit given to certain lower-income, working taxpayers when filing their tax return. Some military senior enlisted and officers – who wouldn’t qualify for this refundable tax credit under normal...

by Attiyya | Jan 23, 2015 | Taxes

By now, most service members and veterans are aware of these VA-guaranteed home loan benefits. No down payment required No mortgage insurance (PMI) required No prepayment penalty However, many are forgetting the added benefit of including these two itemized tax...

by Attiyya | Jan 13, 2015 | Taxes

W-2: Reports your earned income if you worked for an employer 1098: Reports mortgage interest and points you paid 1098-E: Reports student loan interest you paid 1098-T: Reports payments you made for qualified tuition and expenses 1099-MISC/1099-NEC: Reports...