by Attiyya | Apr 27, 2014 | Financial Counseling

Having three kids who we hope to send to college one day, it was important to my husband and I to develop a financial plan soon after they were born. We did the math and realized having them back to back meant paying for college 8 years straight! According to The...

by Attiyya | Apr 27, 2014 | Financial Counseling

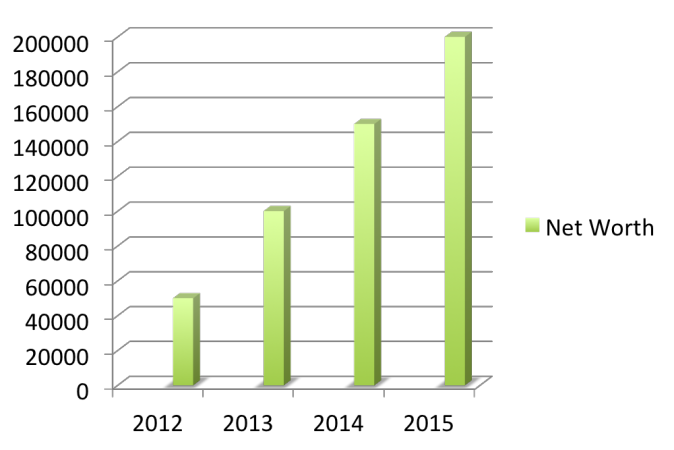

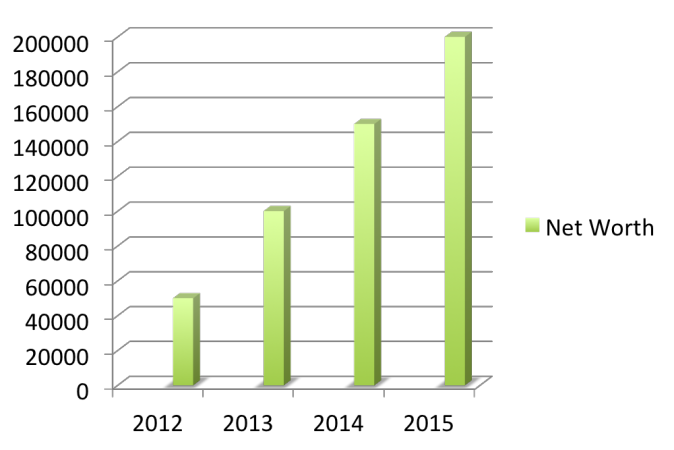

At the end of every year I always take time to calculate our Net Worth. I love that you can simply estimate all of your account and asset values (including your kids savings accounts), deduct the debts you owe and get the results in about 5-10 minutes. The goal is...

by Attiyya | Apr 27, 2014 | Financial Counseling

I feel like it’s our cultural responsibility to bring the best of Germany back with us to the States. With that in mind, we’ve already begun making plans to host “Fest” at our new home. We knew what items we wanted to purchase locally for an...

by Attiyya | Apr 27, 2014 | Financial Counseling

Today I finally snuggled in the bed with my iPad and read the March issue of O magazine. Always looking for ways to be better organized, the cover title “De-Clutter Your Life!” captured my attention right away. As I swiped through the numerous pages, one...

by Attiyya | Apr 27, 2014 | Financial Counseling

We all know her…the friend who buys clothes and hides them in her closet; has a “secret” credit card her husband doesn’t know about; she never tells the complete truth when he asks how much an item really costs; constantly lending money to her extended family...

by Attiyya | Apr 27, 2014 | Financial Counseling

Knowing how to access your FICO score & credit report and understanding what they mean is a crucial first step in fiscal responsibility. I recommend checking both of the above mentioned once a year. For a free copy of your credit report from each of the three...