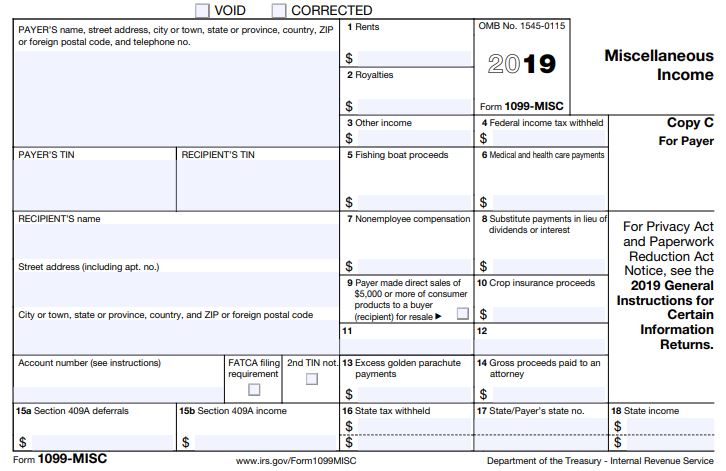

The deadline for 1099-MISC reporting non-employee compensation (NEC) is 31 January 2020. To avoid IRS failure to file penalties, contact me for assistance and to inquire about preparation fees.

The use of Form 1099-MISC is common for small business owners who have paid an independent contractor for a service (e.g., web design, photography, legal advice). If you paid someone any of the following during 2019, you need to issue them a 1099-MISC so they can properly report your payment as income.

- at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest;

- at least $600 in:

- rents;

- services performed by someone who is not your employee;

- prizes and awards;

- other income payments;

- medical and health care payments;

- crop insurance proceeds;

- cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish;

- generally, the cash paid from a notional principal contract to an individual, partnership, or estate;

- payments to an attorney; or

- any fishing boat proceeds